Essay

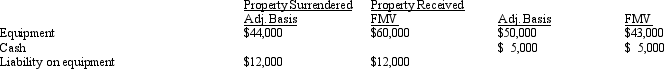

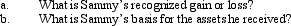

Sammy exchanges equipment used in his business in a like-kind exchange.The property exchanged is as follows:

The other party assumes the liability.

The other party assumes the liability.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: To qualify as a like-kind exchange, real

Q17: The nonrecognition of gains and losses under

Q21: What types of exchanges of insurance contracts

Q29: Which of the following types of transactions

Q33: Which of the following exchanges qualifies for

Q92: Larry, who lived in Maine, acquired a

Q98: In determining the basis of like-kind property

Q177: Pierce exchanges an asset (adjusted basis of

Q195: Taxpayer owns a home in Atlanta.His company

Q207: Brett owns investment land located in Tucson,