Multiple Choice

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land,building,and equipment?

What is Mona's adjusted basis for the land,building,and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If the buyer assumes the seller's liability

Q17: If insurance proceeds are received for property

Q37: Emma gives her personal use automobile (cost

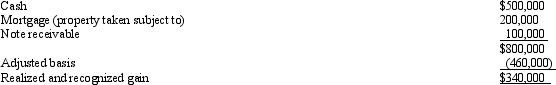

Q52: Ashley sells real property for $280,000.The buyer

Q60: If the amount of a corporate distribution

Q64: Peggy uses a delivery van in her

Q104: Over the past 20 years, Alfred has

Q105: Monroe's delivery truck is damaged in an

Q149: Katie sells her personal use automobile for

Q161: Which of the following is correct?<br>A) The