Essay

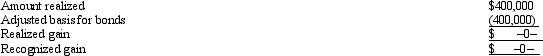

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Kevin purchased 5,000 shares of Purple Corporation

Q45: If the fair market value of the

Q79: Parker bought a brand new Ferrari on

Q82: Melba gives her niece a drill press

Q106: Explain how the sale of investment property

Q121: The holding period of nontaxable stock rights

Q131: Noelle received dining room furniture as a

Q166: Emma gives 1,000 shares of Green, Inc.stock

Q183: The basis of property received by gift

Q219: Carlton purchases land for $550,000. He incurs