Essay

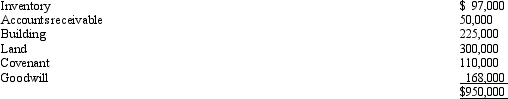

Hubert purchases Fran's jewelry store for $950,000.The identifiable assets of the business are as follows:

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Correct Answer:

Verified

The purchase price is allocate...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Which of the following statements correctly reflects

Q28: A realized gain whose recognition is postponed

Q30: If a husband inherits his deceased wife's

Q73: Robert sold his ranch which was his

Q84: Describe the relationship between the recovery of

Q100: Karen purchased 100 shares of Gold Corporation

Q109: On January 15 of the current taxable

Q114: Misty owns stock in Violet,Inc.,for which her

Q128: Alice owns land with an adjusted basis

Q134: On February 2, 2012, Karin purchases real