Essay

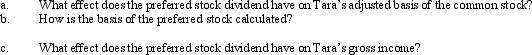

Taylor owns common stock in Taupe,Inc.,with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q56: Mitchell owned an SUV that he had

Q61: Expenditures made for ordinary repairs and maintenance

Q65: If the alternate valuation date is elected

Q71: Realized losses from the sale or exchange

Q73: Why is it generally undesirable to pass

Q82: Alvin is employed by an automobile dealership

Q82: For gifts made after 1976, when will

Q98: The basis of inherited property usually is

Q151: For disallowed losses on related-party transactions, who

Q162: Mike's basis in his stock in Tan