Essay

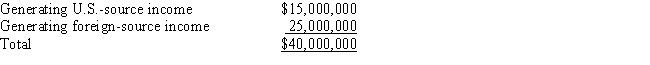

Goolsbee,Inc.,a U.S.corporation,generates U.S.-source and foreign-source gross income.Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000.Using the asset method and the tax book value,apportion interest expense to foreign-source income.

Correct Answer:

Verified

Using the asset method and the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: GoldCo, a U.S. corporation, incorporates its foreign

Q29: Your client holds foreign tax credit (FTC)

Q32: Chang, an NRA, is employed by Fisher,

Q64: The United States has in force income

Q67: An advance pricing agreement (APA) is used

Q156: Columbia,Inc.,a U.S.corporation,receives a $150,000 cash dividend from

Q157: USCo,a U.S.corporation,purchases inventory from distributors within the

Q159: The following persons own Schlecht Corporation,a non-U.S.entity.<br><br><img

Q161: Wellington,Inc.,a U.S.corporation,owns 30% of a CFC that

Q164: Fulton,Ltd.,a foreign corporation,operates a U.S.branch that reports