Essay

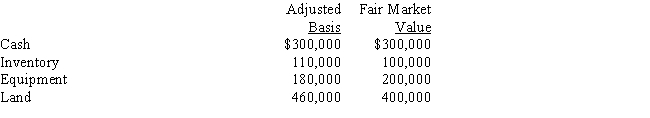

The stock in Crimson Corporation is owned by Angel and Melawi,who are unrelated.Angel owns 60% and Melawi owns 40% of the stock.All of Crimson Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Crimson Corporation:

a.What gain or loss, if any, would Crimson Corporation recognize if it distributes the cash, inventory, and equipment to Angel and the land to Melawi?

b.What gain or loss, if any, would Crimson Corporation recognize if it distributes the equipment and land to Angel and the cash and inventory to Melawi?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The stock of Lavender Corporation is held

Q4: Magenta Corporation acquired land in a §

Q5: Pursuant to a complete liquidation, Oriole Corporation

Q9: Dipper Corporation is acquiring Bulbul Corporation by

Q19: Indigo has a basis of $1 million

Q22: For a corporate restructuring to qualify as

Q51: The stock in Rhea Corporation is owned

Q53: Cotinga Corporation is acquiring Petrel Corporation through

Q57: If a parent corporation makes a §

Q104: Explain why the antistuffing rules were enacted