Multiple Choice

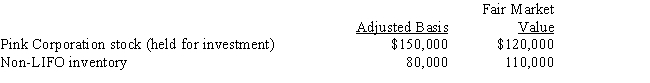

In the current year,Warbler Corporation (E & P of $250,000) made the following property distributions to its shareholders (all corporations) :

Warbler Corporation is not a member of a controlled group.As a result of the distribution:

A) The shareholders have dividend income of $200,000.

B) The shareholders have dividend income of $260,000.

C) Warbler has a recognized gain of $30,000 and a recognized loss of $30,000.

D) Warbler has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Do noncorporate and corporate shareholders typically have

Q43: For purposes of a partial liquidation, a

Q60: Using the legend provided, classify each statement

Q66: A corporate shareholder that receives a constructive

Q69: Vireo Corporation redeemed shares from its sole

Q144: In a property distribution, the amount of

Q161: Lupe and Rodrigo, father and son, each

Q162: Which one of the following statements about

Q166: Pink Corporation declares a nontaxable dividend payable

Q167: Betty's adjusted gross estate is $9 million.The