Multiple Choice

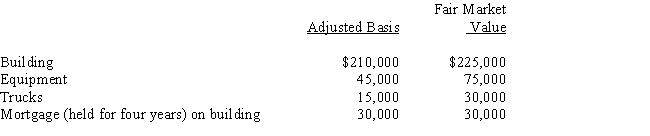

Rick transferred the following assets and liabilities to Warbler Corporation.

In return,Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: In order to encourage the development of

Q25: Nick exchanges property (basis of $100,000; fair

Q26: In structuring the capitalization of a corporation,

Q34: Gabriella and Maria form Luster Corporation with

Q43: A shareholder contributes land to his wholly

Q57: Similar to like-kind exchanges, the receipt of

Q62: In order to induce Yellow Corporation to

Q94: Joe and Kay form Gull Corporation. Joe

Q95: To help avoid the thin capitalization problem,

Q105: Trish and Ron form Pine Corporation. Trish