Essay

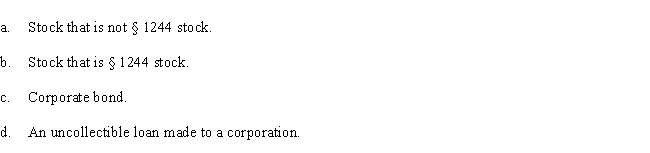

What are the tax consequences if an individual investor incurs a loss on the following:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Sean, a sole proprietor, is engaged in

Q16: What is the rationale underlying the tax

Q31: If a shareholder owns stock received as

Q32: Ann transferred land worth $200,000, with a

Q84: Kevin and Nicole form Indigo Corporation with

Q85: Rachel owns 100% of the stock of

Q86: Four years ago, Don, a single taxpayer,

Q91: A city contributes $500,000 to a corporation

Q96: The receipt of nonqualified preferred stock in

Q106: If both §§ 357(b) and (c) apply