Multiple Choice

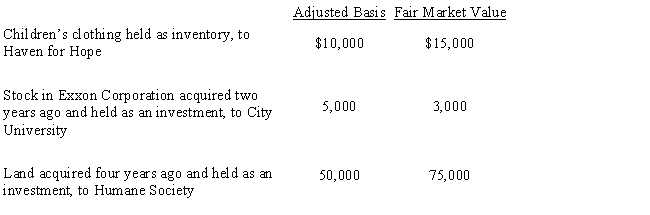

During the current year,Owl Corporation (a C corporation) ,a retailer of children's apparel,made the following donations to qualified charitable organizations.

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Donald owns a 45% interest in a

Q12: During the current year,Sparrow Corporation,a calendar year

Q12: Contrast the tax treatment of capital gains

Q15: Briefly discuss the requirements for the dividends

Q18: Which of the following statements is incorrect

Q20: Rachel is the sole member of an

Q22: On December 31,2017,Flamingo,Inc.,a calendar year,accrual method C

Q49: Jake, the sole shareholder of Peach Corporation,

Q58: What is the annual required estimated tax

Q64: Azure Corporation, a C corporation, had a