Essay

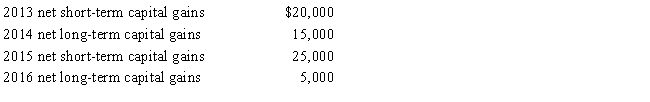

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2017.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

a.How are the capital gains and losses treated on Ostrich's 2017 tax return?

b.Determine the amount of the 2017 net capital loss that is carried back to each of the previous years.

c.Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d.If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2017 tax return?

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Contrast the tax treatment of capital gains

Q18: Which of the following statements is incorrect

Q20: Rachel is the sole member of an

Q22: On December 31,2017,Flamingo,Inc.,a calendar year,accrual method C

Q23: During the current year, Violet, Inc., a

Q27: Almond Corporation,a calendar year C corporation,had taxable

Q28: Lucinda is a 60% shareholder in Rhea

Q54: Schedule M-1 of Form 1120 is used

Q58: What is the annual required estimated tax

Q62: Carol and Candace are equal partners in