Essay

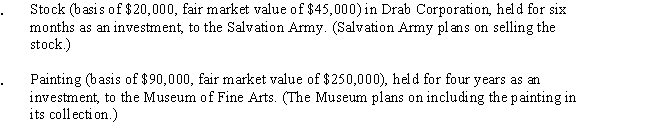

During the current year,Gray Corporation,a C corporation in the financial services business,made charitable contributions to qualified organizations as follows:

Gray Corporation's taxable income (before any charitable contribution deduction) is $1.8 million.

a.What is the total amount of Gray's charitable contributions for the year?

b.What is the amount of Gray's charitable contribution deduction in the current year, and what happens to any excess charitable contribution, if any?

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Employment taxes apply to all entity forms

Q51: Which of the following statements is incorrect

Q52: A personal service corporation with taxable income

Q54: During the current year,Kingbird Corporation (a calendar

Q57: Beige Corporation,a C corporation,purchases a warehouse on

Q58: Copper Corporation,a C corporation,had gross receipts of

Q60: As a general rule,C corporations must use

Q80: What is the purpose of Schedule M-3?

Q95: If a C corporation uses straight-line depreciation

Q108: Income that is included in net income