Essay

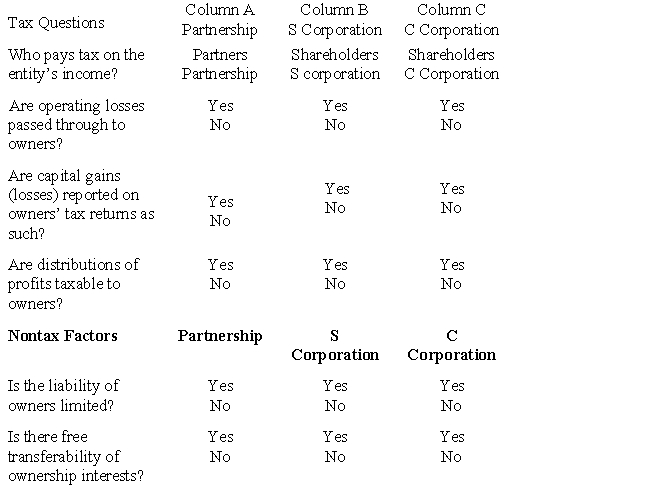

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Norma formed Hyacinth Enterprises,a proprietorship,in the current

Q6: Azul Corporation,a calendar year C corporation,received a

Q7: Pink,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q18: A personal service corporation must use a

Q27: Briefly describe the accounting methods available for

Q41: Don, the sole shareholder of Pastel Corporation

Q64: During the current year, Woodchuck, Inc., a

Q99: Briefly describe the charitable contribution deduction rules

Q108: Which of the following statements is correct

Q109: Schedule M-3 is similar to Schedule M-1