Multiple Choice

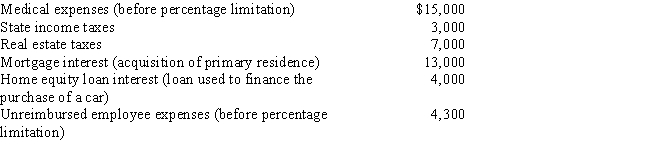

Mitch,who is single and age 46 and has no dependents,had AGI of $100,000 this year.His potential itemized deductions were as follows.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

A) $10,000.

B) $12,300.

C) $16,300.

D) $34,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The AMT adjustment for research and experimental

Q15: Sand Corporation, a calendar year C corporation,

Q16: Why is there no AMT adjustment for

Q31: Madge's tentative minimum tax (TMT) is $112,000.Her

Q68: In 2017, Brenda has calculated her regular

Q88: C corporations are not required to make

Q103: In 2017, Glenn recorded a $108,000 loss

Q108: In 2017, Linda incurs circulation expenses of

Q115: A, B and C are each single,

Q134: Which of the following statements is correct?<br>A)