Essay

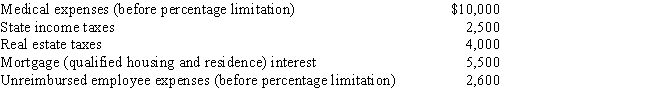

Cindy,who is single and age 48,has no dependents and has adjusted gross income of $50,000 in 2017.Her potential itemized deductions are as follows.

What are Cindy's AMT adjustments for itemized deductions for 2017?

Correct Answer:

Verified

Cindy's adjustments ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Kerri, who has AGI of $120,000, itemized

Q14: AMT adjustments can be positive or negative,

Q20: The recognized gain for regular income tax

Q24: Eula owns a mineral property that had

Q28: Interest on a home equity loan cannot

Q59: Use the following selected data to calculate

Q82: Since most tax preferences are merely timing

Q113: Dale owns and operates Dale's Emporium as

Q122: Durell owns a construction company that builds

Q132: Which of the following statements is correct?<br>A)If