Essay

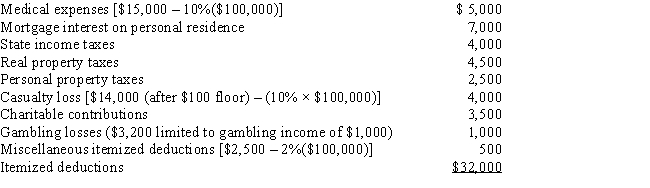

Darin,who is age 30,records itemized deductions in calculating 2017 taxable income as follows.

a.Calculate Darin's itemized deductions for AMT purposes using the direct method.

b.Calculate Darin's itemized deductions for AMT purposes using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The net capital gain included in an

Q15: Sand Corporation, a calendar year C corporation,

Q19: How can interest on a private activity

Q30: For individual taxpayers, the AMT credit is

Q35: The sale of business property could result

Q35: Akeem, who does not itemize, incurred a

Q48: When qualified residence interest exceeds qualified housing

Q51: What is the relationship between the regular

Q52: Vinny's AGI is $250,000. He contributed $200,000

Q96: Joel placed real property in service in