Essay

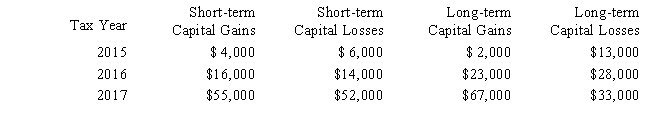

The chart below details Sheen's 2015,2016,and 2017 stock transactions.What is the capital loss carryover to 2017 and what is the net capital gain or loss for 2017?

Correct Answer:

Verified

The 2016 capital loss carryforward is $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Red Company had an involuntary conversion on

Q25: Hank inherited Green stock from his mother

Q45: Martha has both long-term and short-term 2016

Q52: A business machine purchased April 10, 2015,

Q56: Ryan has the following capital gains and

Q57: The following assets in Jack's business were

Q63: Section 1245 applies to amortizable § 197

Q66: An individual had the following gains and

Q76: A worthless security had a holding period

Q108: Which of the following is correct?<br>A) Improperly