Essay

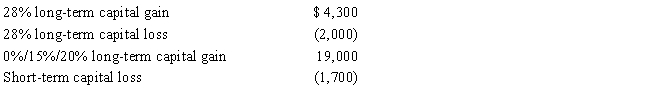

Harold is a head of household,has $27,000 of taxable income in 2017 from non-capital gain or loss sources,and has the following capital gains and losses:

Ignore standard deductions and exemptions.What is Harold's taxable income and the tax on that taxable income?

Correct Answer:

Verified

Harold has taxable income of $46,600 and...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: On January 10, 2017, Wally sold an

Q24: Rental use depreciable machinery held more than

Q27: Section 1231 property generally does not include

Q29: Property sold to a related party that

Q43: Carol had the following transactions during 2017:

Q55: In 2017, an individual taxpayer has $863,000

Q66: Which of the following statements is correct?<br>A)

Q111: Which of the following assets held by

Q120: The chart below describes the § 1231

Q121: The chart below describes the § 1231