Multiple Choice

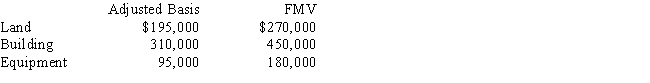

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:

What is Mona's adjusted basis for the land,building,and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A realized gain on the sale or

Q14: The taxpayer must elect to have the

Q21: What types of exchanges of insurance contracts

Q24: Jared, a fiscal year taxpayer with a

Q65: During 2017, Zeke and Alice, a married

Q98: In determining the basis of like-kind property

Q114: Janice bought her house in 2008 for

Q121: An office building with an adjusted basis

Q141: If the alternate valuation date is elected

Q239: How is the donee's basis calculated for