Multiple Choice

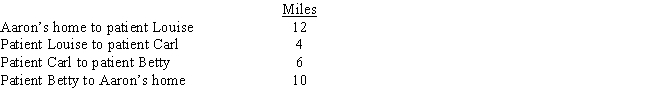

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: In choosing between the actual expense method

Q35: Match the statements that relate to each

Q37: Madison and Christopher are staff accountants at

Q50: For tax purposes, a statutory employee is

Q66: Corey is the city sales manager for

Q68: Match the statements that relate to each

Q69: Bob lives and works in Newark, NJ.He

Q75: Due to a merger,Allison transfers from Miami

Q144: Travis holds rights to a skybox (containing

Q144: Sue performs services for Lynn. Regarding this