Multiple Choice

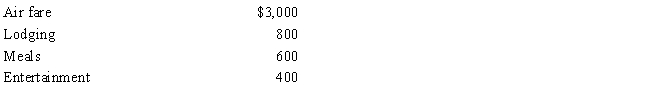

During the year,Sophie went from Omaha to Lima (Peru) on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Sophie's unreimbursed expenses are:

Sophie's deductible expenses are:

A) $4,300.

B) $3,100.

C) $2,800.

D) $2,500.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Tracy, the regional sales director for a

Q17: Under the right circumstances, a taxpayer's meals

Q33: In contrasting the reporting procedures of employees

Q34: Jacob is a landscape architect who works

Q38: When is a taxpayer's work assignment in

Q77: Aiden performs services for Lucas. Which, if

Q103: Match the statements that relate to each

Q137: Sue performs services for Lynn. Regarding this

Q167: For the current football season, Tern Corporation

Q177: For tax year 2016, Taylor used the