Essay

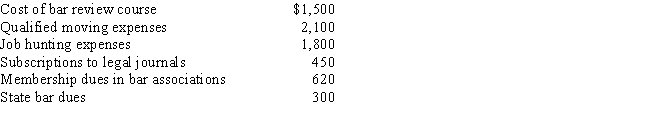

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Correct Answer:

Verified

$770.AGI is $30,000 [$32,100 (salary) - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: How are combined business/pleasure trips treated for

Q26: Under the actual cost method, which, if

Q37: Nick Lee is a linebacker for the

Q39: Mallard Corporation pays for a trip to

Q49: Sue performs services for Lynn. Regarding this

Q60: Which, if any, of the following expenses

Q73: Faith just graduated from college and she

Q83: A taxpayer who uses the automatic mileage

Q89: For tax purposes, travel is a broader

Q128: Which, if any, of the following factors