Essay

Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

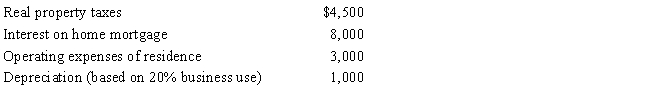

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business (i.e.,500 square feet).Gross income from the business is $13,000,while expenses (other than home office) are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a.If he uses the regular (actual expense) method of computing the deduction for office in the home?

b.If he uses the simplified method?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Regarding tax favored retirement plans for employees

Q9: James has a job that compels him

Q73: Jake performs services for Maude.If Maude provides

Q78: Sue performs services for Lynn. Regarding this

Q98: Qualified moving expenses include the cost of

Q120: Taylor performs services for Jonathan on a

Q123: A deduction for parking and other traffic

Q174: Cathy takes five key clients to a

Q174: Meredith holds two jobs and attends graduate

Q181: After graduating from college,Clint obtained employment in