Essay

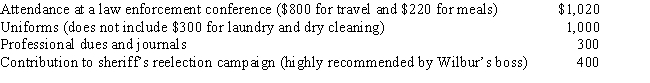

For the current year,Wilbur is employed as a deputy sheriff of a county.He has AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

$1,510.$910 + $1,300 + $300 = $2,510 - (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: A worker may prefer to be treated

Q13: In choosing between the actual expense method

Q14: Ethan, a bachelor with no immediate family,

Q16: Traditional IRA contributions made after an individual

Q50: For tax purposes, a statutory employee is

Q75: Due to a merger,Allison transfers from Miami

Q80: Paul is employed as an auditor by

Q92: If an employer's contribution to a SEP

Q100: Allowing for the cutback adjustment (50% reduction

Q172: Which, if any, of the following expenses