Multiple Choice

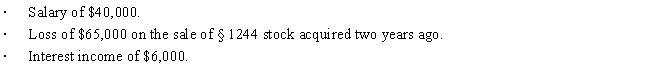

John files a return as a single taxpayer.In 2017,he had the following items:

Determine John's AGI for 2017.

A) ($5,000) .

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Jed is an electrician. Jed and his

Q8: The amount of a business loss cannot

Q31: Ivory, Inc., has taxable income of $600,000

Q44: Three years ago, Sharon loaned her sister

Q47: A taxpayer can carry any NOL incurred

Q52: In determining whether a debt is a

Q53: Sally is an employee of Blue Corporation.

Q74: Susan has the following items for 2017:<br>∙

Q96: A nonbusiness bad debt can offset an

Q124: Discuss the treatment, including the carryback and