Multiple Choice

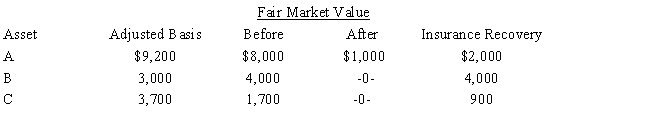

In 2017,Wally had the following insured personal casualty losses (arising from one casualty) .Wally also had $42,000 AGI for the year before considering the casualty.

Wally's casualty loss deduction is:

A) $1,500.

B) $1,600.

C) $4,800.

D) $58,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Discuss the tax treatment of nonreimbursed losses

Q7: Five years ago, Tom loaned his son

Q15: A theft loss is taken in the

Q17: The limit for the domestic production activities

Q20: If a taxpayer sells their § 1244

Q22: The cost of depreciable property is not

Q28: A corporation which makes a loan to

Q42: If an election is made to defer

Q43: John had adjusted gross income of $60,000.During

Q58: How is qualified production activities income (QPAI)