Multiple Choice

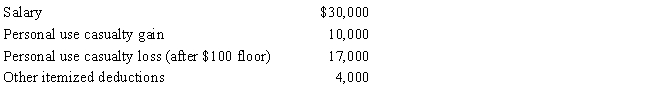

In 2017,Mary had the following items:

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for 2017.

A) $12,550

B) $12,800

C) $13,900

D) $21,900

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: The cost of repairs to damaged property

Q13: Alicia was involved in an automobile accident

Q36: Two years ago, Gina loaned Tom $50,000.

Q55: James is in the business of debt

Q68: Why was the domestic production activities deduction

Q79: Tonya had the following items for last

Q80: Maria,who is single,had the following items for

Q81: Green,Inc.,manufactures and sells widgets.During the current year,an

Q87: An individual may deduct a loss on

Q90: An NOL carryforward is used in determining