Multiple Choice

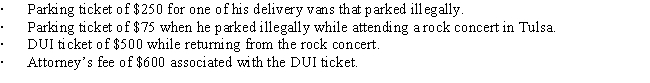

Andrew,who operates a laundry business,incurred the following expenses during the year.

What amount can Andrew deduct for these expenses?

A) $0.

B) $250.

C) $600.

D) $1,425.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: Are there any circumstances under which lobbying

Q22: Describe the circumstances under which a taxpayer

Q47: Tom operates an illegal drug-running operation and

Q50: Rex,a cash basis calendar year taxpayer,runs a

Q51: Priscella pursued a hobby of making bedspreads

Q106: Can a trade or business expense be

Q121: Max opened his dental practice (a sole

Q121: Why are there restrictions on the recognition

Q125: Which of the following are deductions for

Q151: Which of the following is incorrect?<br>A) Alimony