Multiple Choice

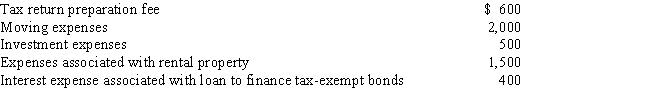

Cory incurred and paid the following expenses:

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: What are the relevant factors to be

Q22: Investigation of a business unrelated to one's

Q44: If part of a shareholder/employee's salary is

Q51: Alfred's Enterprises, an unincorporated entity, pays employee

Q55: Abner contributes $2,000 to the campaign of

Q55: Under the "one-year rule" for the current

Q72: All domestic bribes (i.e., to a U.S.official)

Q87: What losses are deductible by an individual

Q91: If an item such as property taxes

Q112: Are there any exceptions to the rule