Multiple Choice

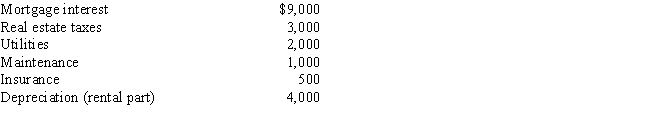

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Assuming an activity is deemed to be

Q12: During the year, Martin rented his vacation

Q15: Which of the following may be deductible?<br>A)Bribes

Q38: On January 2, 2017, Fran acquires a

Q54: If an activity involves horses, a profit

Q58: Which of the following is not deductible?<br>A)Moving

Q81: Briefly discuss the two tests that an

Q83: A taxpayer's note or promise to pay

Q122: What is the appropriate tax treatment for

Q153: Tommy, an automobile mechanic employed by an