Essay

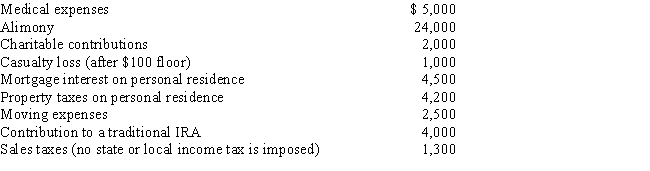

Austin,a single individual with a salary of $100,000,incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

Only the following e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Only the following e...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q7: Expenses incurred for the production or collection

Q10: Walt wants to give his daughter $1,800

Q16: Olive, Inc., an accrual method taxpayer, is

Q27: Which of the following is not a

Q30: Walter sells land with an adjusted basis

Q95: In determining whether an activity should be

Q96: Bob and April own a house at

Q99: Sandra owns an insurance agency.The following selected

Q104: If a taxpayer operates an illegal business,

Q140: Bobby operates a drug-trafficking business. Because he