Essay

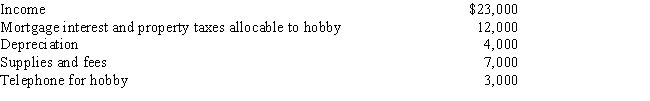

Calculate the net income includible in taxable income for the following hobby:

Correct Answer:

Verified

Otherwise deductible expenses must...

Otherwise deductible expenses must...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Otherwise deductible expenses must...

Otherwise deductible expenses must...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q7: If a vacation home is classified as

Q11: If a vacation home is rented for

Q25: Under what circumstance can a bribe be

Q27: Marsha is single,had gross income of $50,000,and

Q38: Two-thirds of treble damage payments under the

Q72: Which of the following can be claimed

Q79: An expense need not be recurring in

Q107: How can an individual's consultation with a

Q122: Mitch is in the 28% tax bracket.

Q149: Which of the following is a required