Multiple Choice

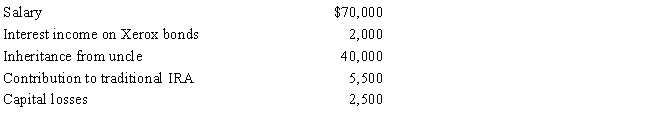

During 2017,Esther had the following transactions:

Esther's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q25: Sarah furnishes more than 50% of the

Q44: A child who is married cannot be

Q58: When married persons file a joint return,

Q59: During the current year, Doris received a

Q69: When separate income tax returns are filed

Q74: In terms of the tax formula applicable

Q79: In meeting the criteria of a qualifying

Q89: Under the Federal income tax formula for

Q92: Stuart has a short-term capital loss, a

Q180: The Deweys are expecting to save on