Multiple Choice

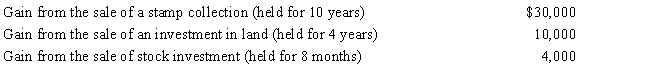

Perry is in the 33% tax bracket.During 2017,he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (33% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (33% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (33% × $4,000) .

D) (15% × $40,000) + (33% × $4,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: During 2017,Madison had salary income of $80,000

Q32: When filing their Federal income tax returns,

Q47: An individual taxpayer uses a fiscal year

Q73: Which, if any, of the following statements

Q121: Match the statements that relate to each

Q127: Match the statements that relate to each

Q132: Regarding the tax formula and its relationship

Q134: In which, if any, of the following

Q138: Match the statements that relate to each

Q145: In applying the gross income test in