Multiple Choice

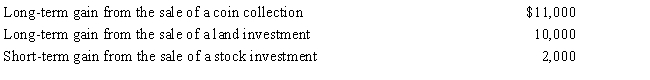

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2017:

Kirby's tax consequences from these gains are as follows:

A) (5% × $10,000) + (15% × $13,000) .

B) (15% × $13,000) + (28% × $11,000) .

C) (0% × $10,000) + (15% × $13,000) .

D) (15% × $23,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The basic and additional standard deductions both

Q72: When the kiddie tax applies, the child

Q82: Because they appear on page 1 of

Q85: For 2017, Tom has taxable income of

Q94: Matching <br>Regarding classification as a dependent, classify

Q97: Match the statements that relate to each

Q101: In resolving qualified child status for dependency

Q119: Matching <br>Regarding classification as a dependent, classify

Q130: Kyle and Liza are married and under

Q166: In early 2017, Ben sold a yacht,