Multiple Choice

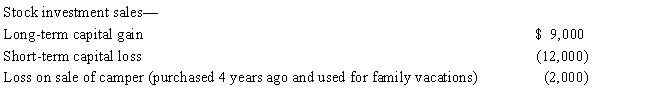

For the current year,David has wages of $80,000 and the following property transactions:

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: In 2017, Hal furnishes more than half

Q36: Which of the following items, if any,

Q49: Match the statements that relate to each

Q81: As opposed to itemizing deductions from AGI,

Q87: During the year, Kim sold the following

Q110: Under the Federal income tax formula for

Q117: Match the statements that relate to each

Q117: Katrina, age 16, is claimed as a

Q122: Tony, age 15, is claimed as a

Q127: Mel is not quite sure whether an