Essay

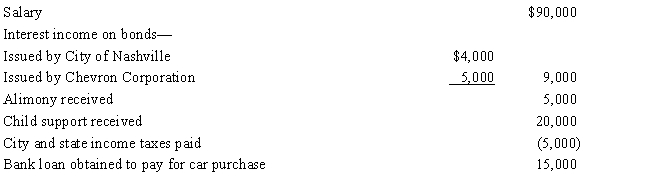

Emily had the following transactions during 2016:

What is Emily's AGI for 2017?

Correct Answer:

Verified

$100,000.$90,000 (salary) + $5,000 (inte...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$100,000.$90,000 (salary) + $5,000 (inte...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q40: Which, if any, of the following is

Q40: Match the statements that relate to each

Q54: The Dargers have itemized deductions that exceed

Q62: Matching <br>Regarding classification as a dependent, classify

Q69: Match the statements that relate to each

Q77: Married taxpayers who file separately cannot later

Q79: Married taxpayers who file a joint return

Q105: Maude's parents live in another state and

Q123: In determining whether the gross income test

Q128: Once a child reaches age 19, the