Essay

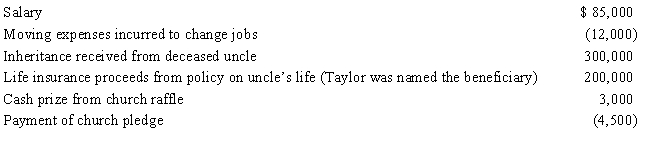

Taylor had the following transactions for 2017:

What is Taylor's AGI for 2017?

Correct Answer:

Verified

$76,000.$85,000 (salary) + $3,000 (raffl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$76,000.$85,000 (salary) + $3,000 (raffl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q23: Matching <br>Regarding classification as a dependent, classify

Q26: After her divorce, Hope continues to support

Q33: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q49: Butch and Minerva are divorced in December

Q50: Many taxpayers who previously itemized will start

Q51: When can a taxpayer not use Form

Q57: Jason and Peg are married and file

Q74: Warren, age 17, is claimed as a

Q173: During 2017,Trevor has the following capital transactions:<br>After

Q177: During 2017,Sarah had the following transactions:<br>Sarah's AGI