Essay

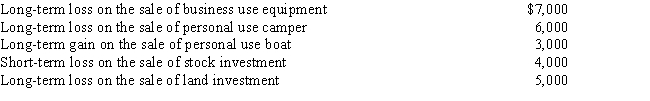

During the year,Irv had the following transactions:

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q15: Regarding head of household filing status, comment

Q29: Kyle, whose wife died in December 2014,

Q51: Darren, age 20 and not disabled, earns

Q82: Katelyn is divorced and maintains a household

Q97: Match the statements that relate to each

Q114: Currently, the top income tax rate in

Q127: Match the statements that relate to each

Q128: During 2017,Addison has the following gains and

Q129: Matching <br>Regarding classification as a dependent, classify

Q178: Lena is 66 years of age, single,