Multiple Choice

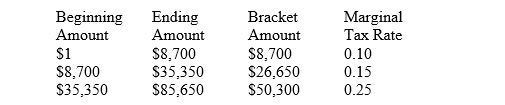

Following is a partial 2012 personal income tax schedule for a single filer:

-The dollar amount of income taxes paid by a single filer who has taxable income of $8,700 would be:

A) $150

B) $870

C) $3,840

D) $4,675

E) $10,385

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Financial bootstrapping maximizes the need for financial

Q22: Which of the following are intellectual property

Q25: The marginal tax rate for the first

Q28: The average tax rate for a corporation

Q38: A trademark must be novel in order

Q41: Based on 2012 tax laws,the highest possible

Q45: Which of the following is not a

Q52: The maximum number of owners in a

Q83: The equity capital sources for a proprietorship

Q92: A work does not need to be