Multiple Choice

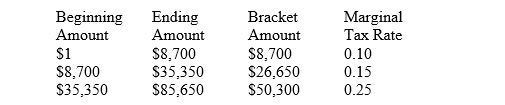

Following is a partial 2012 personal income tax schedule for a single filer:

-The average tax rate for a single filer with taxable income of $35,350 would be:

A) 10.0%

B) 13.8%

C) 15.0%

D) 16.7%

E) 20.0%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Professional corporations (PCs)and service corporations (SCs)are corporate

Q23: Which form of business organization is characterized

Q26: Based on 2012 tax schedules,the first dollar

Q27: Based on 2012 tax schedules,the first dollar

Q31: Which form of business organization typically offers

Q33: Based on 2012 tax schedules,the highest marginal

Q49: An idea is enough to be patented.

Q60: There are four kinds of patents.

Q71: The articles of incorporation are the basic

Q91: Patents are intellectual property rights granted for