Multiple Choice

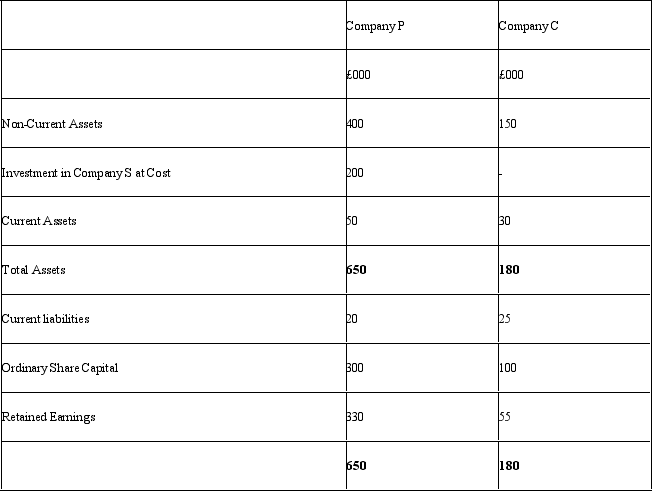

The Statements of Financial Position for company P and company C are shown below:

At the time of the acquisition,the net asset value of C was £100,000.This was made up entirely of £100,000 share capital.If company P owns 100% of Company C,then the consolidated Statement of Financial Position will show a Total Assets figure of:

A) £830. This is made up of 100% of the assets of P and C and the investment of P in C

B) £630. This is 100% of the assets of P and C excluding the investment of P in C

C) £730. This is made up of 100% of the assets of P and C and the goodwill on the investment of P in C

D) £585. This is made up of 100% of the assets and liabilities of P and C

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The following segmental information is provided

Q16: In a group or consolidated balance sheet,the

Q17: Which of the following would not form

Q18: "Minority interest" refers to the owners of

Q19: The following segmental information is provided

Q20: The following segmental information is provided

Q21: The Statements of Financial Position for company

Q23: The following segmental information is provided

Q24: A company with interest cover of 10

Q25: A company is about to buy another