Multiple Choice

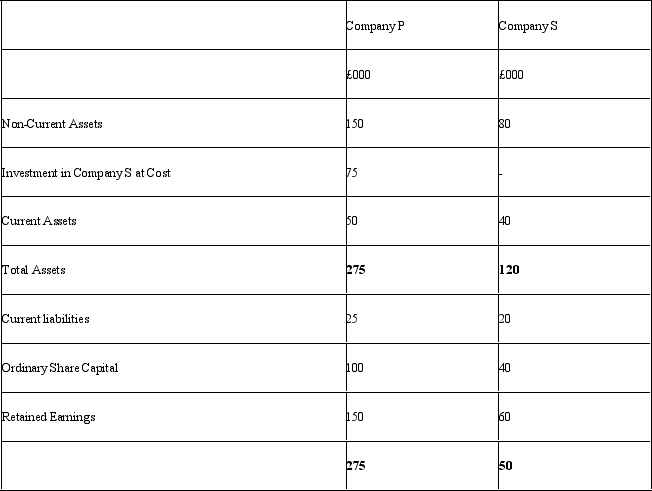

The Statements of Financial Position for company P and company S are shown below:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include:

A) 100% of the assets and liabilities of P and 75% of the assets and liabilities of S

B) 100% of the assets and liabilities of P and 50% of the assets and liabilities of S

C) 100% of the assets and liabilities of P and 100% of the assets and liabilities of S

D) 75% of the assets and liabilities of P and 75% of the assets and liabilities of S

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following would you associate

Q2: If one company buys another for less

Q3: According to Altman (1983)the amount of working

Q4: Deferred taxation is a "liability" that may

Q6: Which of the following z-scores would suggest

Q7: The International Accounting Standards Board (IASB)require companies

Q8: High levels of debt in a company

Q9: Which of the following is not included

Q10: Which of the following are potential indicators

Q11: When a company is in financial distress,creditors