Essay

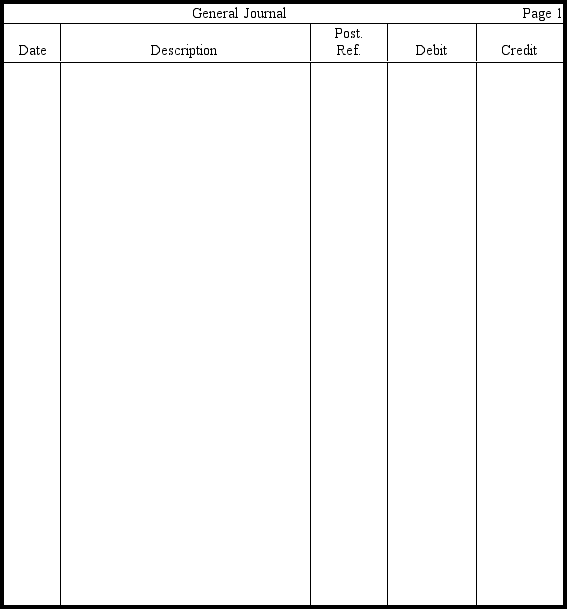

Using the journal provided,enter the following transactions for LaPana Corporation for 2009 and 2010.Please provide all explanations.

2009

Aug. 13 Purchased 1,000 shares of Casper Corporation stock for . These securities were purchased primarily for trading purposes.

Oct. 5 Purchased 4,000 shares of Tally Corporation stock for . These securities were purchased primarily for trading purposes.

Nov. 1 Invested in 120 -day U.S. Treasury bills that have a maturity value of .

Dec. 31 The market value of the Casper Corporation shares is , and the market value of the Tally Corporation stock is . A year-end adjustment is made.

31 A year-end adjustment is made for accrued interest on the Treasury bills.

2010

Mar. 1 Received maturity value of U.S. Treasury bills in cash.

Apr. 14 Sold all 1,000 shares of Casper Corporation stock for .

Sept. 22 Received dividends of per share from Tally Corporation.

Dec. 31 The market value of the Tally Corporation shares is . A year-end adjustment is made.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: When the cost-adjusted-to-market method is used to

Q16: Use this information to answer the

Q18: When the accounting period ends before U.S.Treasury

Q20: Match each of the following terms with

Q21: The financial statements of a foreign subsidiary

Q80: Under the cost-adjusted-to-market method of accounting for

Q85: When a company receives a dividend from

Q87: Goodwill is the amount by which specific

Q92: An ownership interest of greater than 50

Q93: Dividends received on investments are accounted for