Essay

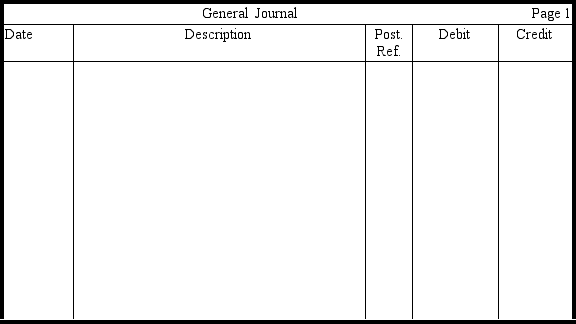

On June 1,2008,Will Oldman,treasurer of A-One Corporation,received an option to purchase 2,000 shares of A-One $5 par value common stock for $20 per share any time during 2009 or 2010.Oldman exercised his option on May 14,2009.The market price of the stock was $20 per share on June 1,2008,and $25 per share on May 14,2009.Provide the entry in journal form to record the exercise of the option on A-One's books.Show computations.(Omit explanation.)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A corporation is a separate entity for

Q14: Treasury stock usually is recorded at par

Q21: The excess of the issuance price over

Q40: Compensation expense related to employee stock option

Q52: A corporation records a dividend-related liability<br>A)on the

Q75: The information that follows pertains to

Q88: Treasury shares are shares that are issued

Q140: The contributed capital of a corporation does

Q157: The death of a stockholder results in

Q216: If Willis Corporation has 80,000 shares of