Essay

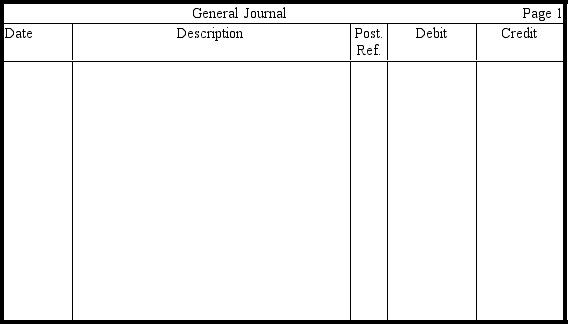

Mertz Motors Corporation has 2,000,000 authorized shares of $10 par value common stock.As of June 30,20xx,there were 1,000,000 shares issued and outstanding.On June 30,20xx,the board of directors declared a $0.20 per share cash dividend to be paid on August 1,2010,to shareholders of record on July 15,20xx.Prepare the necessary entries in journal form to be recorded on (a)the date of declaration,(b)the date of record,and (c)the date of payment.(Omit explanations.)

Correct Answer:

Verified

Correct Answer:

Verified

Q31: The limited liability of a stockholder can

Q41: Use the following information to answer

Q60: A corporation has 10,000 shares of 8

Q79: Start-up and organization costs include all of

Q102: How is it possible for a corporation

Q121: The par value of stock refers to

Q131: The board of directors of Irondale Corporation

Q153: Cash dividends become a liability of a

Q173: Corporate earnings are subject to double taxation.

Q173: A liquidating dividend is<br>A) a dividend that