Short Answer

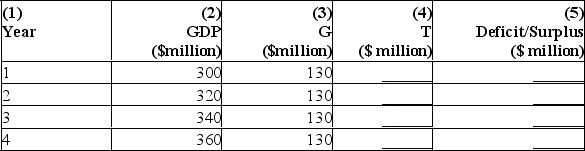

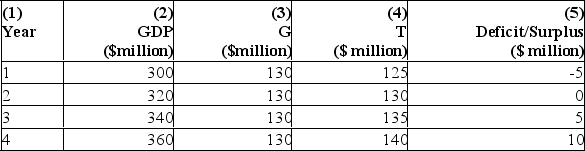

Suppose the government Daikai balances its budget over a five-year period.Autonomous taxes are $50 and the marginal tax rate is 25%.The following table shows the level of GDP and government expenditure in each of the first 5 years:

a)Fill in column (4)and (5).Suppose the level of GDP for Year 5 is $380 million.

a)Fill in column (4)and (5).Suppose the level of GDP for Year 5 is $380 million.

b)What level of government spending in Year 5 will balance the budget over the five-year cycle?

c)What level of autonomous taxes in Year 5 will balance the budget over the five-year cycle?

a)

Correct Answer:

Verified

a)to calculate (4)T ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Which of the following is not part

Q24: Below is some information about the state

Q25: Which of the following is a legitimate

Q26: Counter-cyclical fiscal policy aimed at closing an

Q27: When does a government budget surplus exist?<br>A)When

Q29: Below is some data for a hypothetical

Q30: Which of the following is true if

Q31: A decrease in autonomous taxes would pivot

Q32: All of the following,except one,are arguments against

Q33: If the government used counter-cyclical policy to