True/False

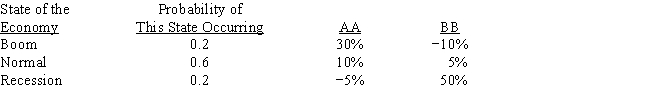

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational, risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: In portfolio analysis, we often use ex

Q44: Freedman Flowers' stock has a 50% chance

Q50: In historical data, we see that investments

Q56: Paul McLaren holds the following portfolio: Paul

Q64: We would almost always find that the

Q75: Charlie and Lucinda each have $50,000 invested

Q85: Which of the following is NOT a

Q130: For a stock to be in equilibrium,

Q139: "Risk aversion" implies that investors require higher

Q145: Calculate the required rate of return for