Multiple Choice

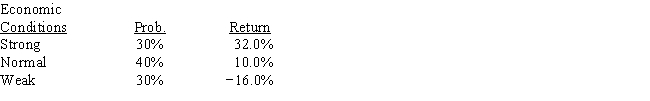

Stuart Company's manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Stock X has a beta of 0.7

Q25: Ivan Knobel holds a well-diversified portfolio that

Q34: Even if the correlation between the returns

Q35: Bloome Co.'s stock has a 25% chance

Q40: Donald Gilmore has $100,000 invested in a

Q48: Two conditions are used to determine whether

Q63: Which of the following are the factors

Q103: Stocks A and B each have an

Q119: If the price of money (e.g., interest

Q144: If you randomly select stocks and add